EXPLAIN THE PMT FUNCTION IN EXCEL

=PMT(rate,Nper,Pv,Fv,Type)

=PMT(rate, nper, pv, [fv=0][type=0])

CALCULATES THE PAYMENTS REQUIRED EACH PERIOD ON A LOAN OR INVESTMENT

THE PMT FUNCTION TAKES THREE REQUIRED ARGUMENTS.

1 – rate = interest rate per period of the loan (per month – divided by 12)

2 – Nper = number of repayment periods (the years – multiplied by 12)

3 – Pv = the principal loan amount – enter the amount of the loan

Fv = future value – the balance you want at the end – leave out = 0

Type = optional – when payments are due

0/omitted = end of period,

1 = start of period

HINT:

FORMULAS – PMT, PV, FV

THE RULES OF THUMB ARE AS FOLLOWS:

IF IT’S MONEY THAT’S LEAVING YOUR HANDS, WHETHER IT’S A DEPOSIT TO AN ACCOUNT OR A PAYMENT FOR A LOAN, THEN THE NUMBER SHOULD BE NEGATIVE

IF IT’S MONEY THAT’S COMING TO YOU, WHETHER YOU’RE RECEIVING A LOAN OR AN INVESTMENT THAT’S MATURED, THEN THE NUMBER SHOULD BE POSITIVE

UNISA OFTEN ASKS FOR THE ANSWER TO RETURN A POSITIVE VALUE. YOU ACHIEVE THIS BY INSERTING A MINUS SIGN IN THE FRONT OF THE FUNCTION NAME OR IN FRONT OF THE PMT OR FV OR PV ARGUMENT DEPENDING ON THE FUNCTION BEING USED.

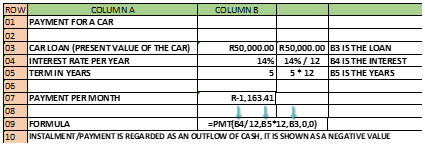

EXAMPLE:

YOU WANT TO BUY A CAR FOR R50 000.

THE BANK CAN FINANCE YOUR CAR PURCHASE AT CONSTANT INTEREST RATE OF 14% PER ANNUM OVER 5 YEARS.

No Comments